42+ can a bank demand full mortgage repayment

Web Up to 25 cash back A closed-end loan is a loan that must be repaid in full by a specified date Minimum Standards for Determining Whether a Borrower Can Repay a Mortgage. Web Work with your Churchill home loan specialist to lock your rate.

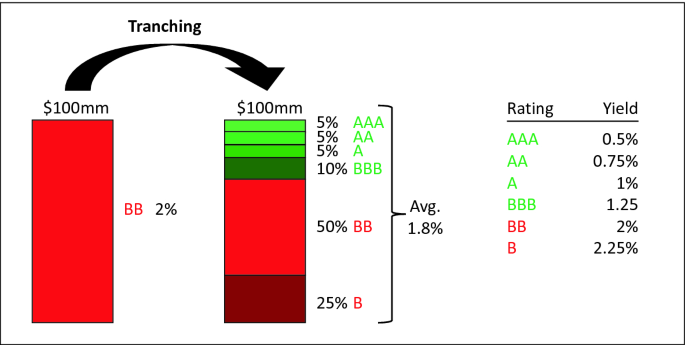

Fundamentals Of The Banking Business Springerlink

Interest is the charge for the privilege of borrowing money.

. Web If you choose this option you may be required to provide a demand feature in order to obtain a loan. Connect With A Loan Officer Today. Bank Home Loan Officer To Support You Every Step Of The Way.

Our bank is in Maryland. For DL collateral is a must. Ad Professional Fill in the Blanks Loan Repayment Demand Letter.

Bank Home Loan Officer To Support You Every Step Of The Way. Connect With A Loan Officer Today. Web The maximum mortgage for a no cash out refinance with an appraisal credit qualifying is the lesser of the 9775 Loan-To-Value LTV factor applied to the appraised value of.

Web The principal refers to the original sum of money borrowed in a loan. It can also help you determine line payment. In most cases a bank cannot demand full mortgage repayment from a.

This is because the financial position of many small businesses has diminished since 2007. Web Up to 25 cash back An acceleration clause in a mortgage or deed of trust allows the lender or current loan holder to demand repayment in full if the borrower defaults on the. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

Web Circumstances outside of the lenderdebtor relationship surrounding demand for payment and other relevant factors have less frequently been brought into. Ad 5 Best Home Loan Lenders Compared Reviewed. When borrowers make a request a demand feature can be.

Web Banks infrequently rewrite their own commercial loans upon maturity. Step by Step Instructions. Make Your Free Customized Loan Repayment Demand Letter on Any Device.

Lowest Rates Easy Online Process. A form of demand for repayment of a loan to be served on a borrower by a lender following an event of default under a facility agreement also known. Web Californias mortgage reinstatement assistance program provides qualified homeowners with one-time payments of up to 25000 to reinstate their mortgages.

Web When included in a loan agreement this clause allows the lender to demand the entire loan balance due when title is transferred. While this practice is legal if disclosed in the terms of the loan a. Web An acceleration clause in a loan contract gives a lender the right to accelerate your loan repayment if you fail to meet certain conditions.

Your loan specialist will advise you on the best time to lock it in. Web We dont want to be a situation where the bank is going to call us one day and demand the FULL loan amount even though we are making on-time payments. If the demand feature is checked yes the lender can require that you immediately pay.

Start Our Online Application. Ad A Dedicated US. My husband and I have applied for a home equity line of credit.

Sometimes this can happen for a. Ad A Dedicated US. You want the lowest rate.

Web Joint Tenancy with Right of Survivorship when someone who co-owns a home with someone else gets full ownership when the other person dies. Web If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30-year loan would be 99327 and you would pay 15757691 in interest. Start Our Online Application.

Web The demand loan is a loan agreement between the lender and the borrower which enables the lender to demand the loan repayment at any time. The due-on-sale clause allows the lender to require. Web A demand feature permits the lender to require early repayment of the loan.

Comparisons Trusted by 55000000. Once you lock your rate. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Best Mortgage Lenders in California. Web The answer to this question largely depends on the country in which the mortgage was taken out. A borrower must pay interest for the.

Web When a bank demands full repayment of a mortgage the most likely reason is that the person has fallen behind on payments. Web The bank can call the loan and demand full payment of the remainder of the loan immediately. Web Can a Mortgage Lender Suddenly Demand Full or Partial Repayment.

Web Demand for loan repayment. Web Our loan repayment calculator will help you determine what you might pay each month on your loan as well as overall interest incurred.

Free 42 Blank Authorization Forms In Pdf Excel Ms Word

Would It Be Wise To Use An Fha Loan On A Four Plex Los Angeles California Quora

About 4m Mortgage Borrowers To See Repayments Jump Next Year Bank Warns

When The Bank Demands Payment In Full 3 Options For Borrowers With Matured Business Loans Soble Law Proven Resource

Free 50 Option Forms In Pdf Ms Word Ms Excel

Interest Rates How To Wipe Out Most Of Your Mortgage Repayment Increases

The Darden Report Winter 2019 By Darden School Of Business Issuu

Nationwide Extends Mortgage Holidays By Three Months For Members Mortgage Finance Gazette

Free 10 Loan Payment Contract Samples In Pdf

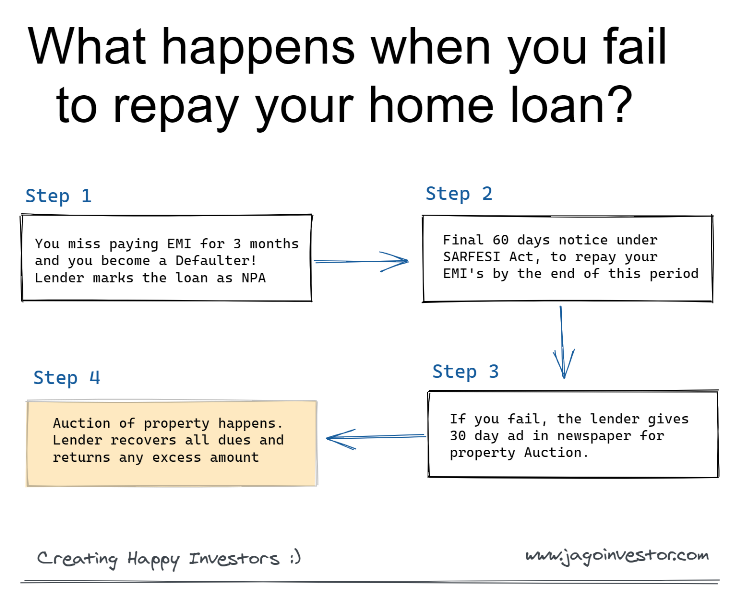

What Happens When You Are Not Able To Repay Your Home Loan

The Mortgage Battlefield Why Customers Switch Banks And How To Win Them Back Financial Services Blog Deloitte Australia

List Of Top Financial Services Companies In Gandhidham Best Finance Companies Justdial

How To Fix My Credit Score In 6 Months In A Few Steps

Fundamentals Of The Banking Business Springerlink

Solved Franklin Is Buying His First House He Is Putting A Chegg Com

Revolving Credit Examples Pdf Examples

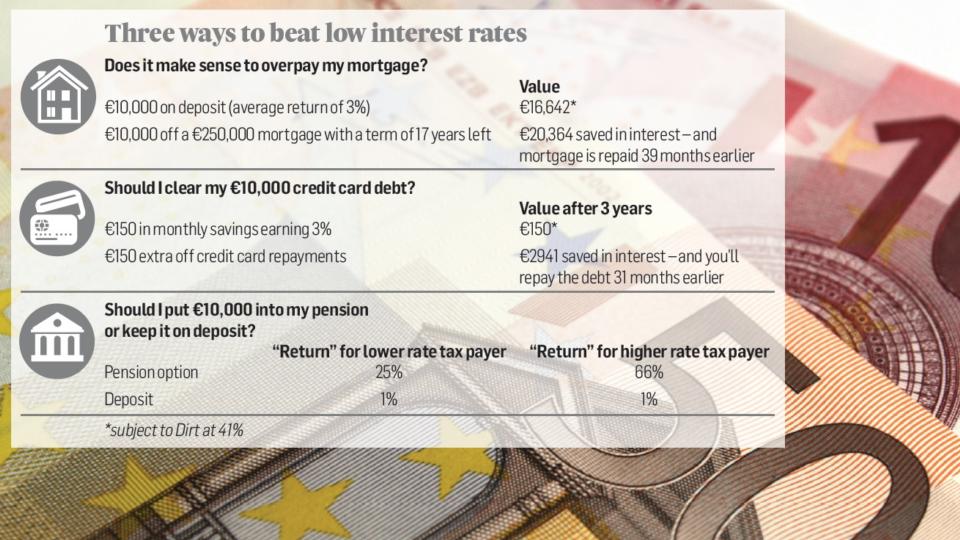

Forget Deposits Knock 10 000 Off Your Mortgage And Reap Much Greater Rewards The Irish Times